Frequently Asked Questions

Click here for Mountain Shadows Metro District board agendas, notices and other information.

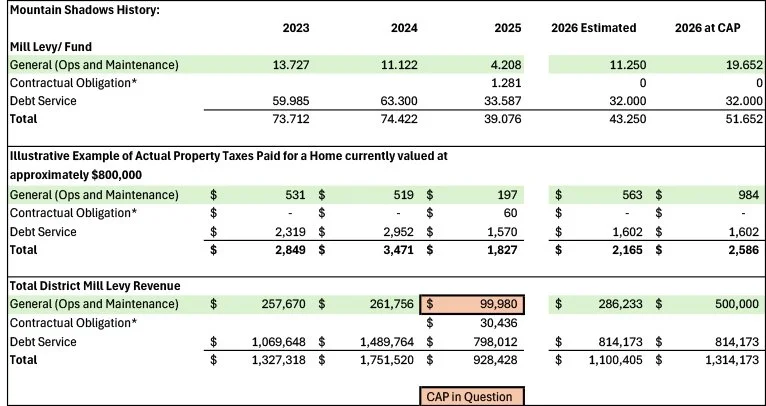

Estimated Homeowner Obligations

If question 6B and 6C pass, the District would continue to assess property taxes to fund a majority of its operations and maintenance budget. If the District were to develop a 2026 O&M budget similar to those of 2024 and earlier, residents could expect to see a property tax increase of around $400-$500 per year. If, in any given year, the District were to deem it necessary to assess the maximum amount allowed by question 6B ($500,000), residents could see a property tax increase of around $900-$1000 per year. These values are only estimates -- actual obligations will depend on the District's budget and the corresponding value of each homeowner's property. Regardless of the amount assessed for O&M, each resident's individual property tax bill would STILL be lower than it was in 2024 because of the steps the District took to refinance its outstanding debt.

If either question 6B or 6C do not pass, the District will be forced to institute a fee system. Under this system, each homeowner would be assessed a flat fee to cover the District's O&M responsibilities -- independent of property value. While the estimated homeowner obligations will likely be similar, it will come with some additional costs (lack of federal tax deduction, administrative costs of the fee system, etc), leading to a slightly higher impact for many residents.

Click here for a PDF of this chart.

Why does the district need additional funding?

The metro district was established to provide infrastructure improvements and amenities to the homeowners in the community. Those improvements include open space and trails, four retention ponds, common areas and fencing, and four parks, two owned by the district and two by the City of Arvada. The district also provides snow removal, irrigation and other ongoing services within the common areas. The $100,000 ceiling set in 2004 for revenue that the district can collect through its general fund mill levy does not provide enough resources to cover the cost increases and inflation over the past 20 years to operate and maintain these community assets, even when combined with other sources of revenue currently available to the district.

How is this year’s proposed funding question different from the 2024 question?

The goals of the 2024 funding question and the proposed 2025 question are similar. The district needs to increase its allowable funding amount to keep pace with inflation and the cost of operating and maintaining the community-owned amenities and assets. It’s important to note that the 2025 measure sets a hard cap on the district’s property tax revenue for operations and maintenance of $500,000.

No matter how much property values increase, the district would not be able to collect more than $500,000 in a fiscal year through the operations and maintenance mill levy, unless it received voter approval in the future to increase that cap.

Will the district need the full $500,000 right now?

The district most likely will not levy the entire $500,000 amount for the foreseeable future. The proposed 2025 question will allow the Board to set a collection amount and mill levy necessary to meet the operations and maintenance needs of the district. Based on the 2023 and 2024 budgets, the district needs to receive approximately $265,000 in property taxes to fund its operations and maintenance expenses. This would allow the district to restore services like landscape improvements, site clean-up, pet-waste stations and retention-pond improvements that were eliminated in the 2025 budget to stay within the $100,000 tax revenue ceiling.

Is the $500,000 cap sufficient? Will the district come back for more in the future?

The district’s board and financial advisors have reviewed funding needs for the next 10 to 20 years and believe the $500,000 cap is sufficient for the district’s long-term fiscal health. A major consideration is the City of Arvada taking over the responsibility to maintain its two parks in 2036. The district is required under various agreements to maintain these city parks. The transition of the maintenance of these parks to the city in 2036 will significantly reduce the district’s annual budget, allowing the board to focus funds on the remaining services and improvements.

How much will the funding question increase property taxes?

If the Board decided to levy the full $500,000 amount allowed, it would increase taxes by approximately $980 per year or $81.67 per month. However, that would not be the Board’s intention at this time. The board would likely increase its operations and maintenance mill levy to about $265,000 to restore the budget levels in 2023 and 2024. This would increase taxes by about $500 per year or $41.67 per month.

Why is it important to maintain the community assets and restore maintenance funding?

Homeowners enjoy the open space, parks and other amenities within our community. Keeping community-owned features well maintained allows us to enjoy our community and helps increase property and resale values. If the community’s assets go into disrepair, it will cost much more later to repair or replace, possibly requiring a tax increase just to address these issues. In addition, keeping common areas maintained, including snow removal, impacts the safety of the neighborhood.

Why is the second ballot question needed?

The General Assembly set a 5.25 percent annual revenue growth cap on operations and maintenance revenue to prevent large increases in property taxes. However, this cap does not take into account increases in inflation, the cost of labor and other factors impacting the district’s operations that might require the district to raise revenue in any given year in excess of 5.25% of the prior year. Approving this question would allow the district to manage inflation and increase in a given budget year. It would also allow the district to build a capital-improvements reserve to address large scale projects like fence replacement. It is important to note that this revenue growth limitation is looked at on an annual basis, and opting out of this revenue growth limitation does not mean that the district would ever be able to collect more in taxes for operations and maintenance than allowed by the district electoral authorization (currently $100,000 or $500,000 if the first election question passes).

How can we monitor the metro district’s spending and budgets?

Mountain Shadows Metro District is required by state law to follow open meeting and transparency laws. All board meetings and district materials are available to the public. The board is entirely composed of fellow residents and any eligible elector within the district can seek to join the board. Information about the metro district can be found by visiting https://engage.goenumerate.com/site/6089/.